UK Defense and Brexit: The Impact of the Australian Frigate Decision

With Britain sorting out Brexit and the European states facing an uncertain future over the way ahead with regard to the structure of Europe itself, defense becomes a vortex for both continuity and change.

On the one hand, President Macron has been reaching out to include Britain in the future of European defense through his proposal on a European crisis force.

Nine EU nations will on Monday (25 June) formalise a plan to create a European military intervention force, a French minister said, with Britain backing the measure as a way to maintain strong defence ties with the bloc after Brexit.

The force, known as the European Intervention Initiative and championed by French President Emmanuel Macron, is intended to be able to deploy rapidly to deal with crises.

A letter of intent is due to be signed in Luxembourg on Monday by France, Germany, Belgium, Britain, Denmark, the Netherlands, Estonia, Spain and Portugal, French defence minister Florence Parly told the newspaper Le Figaro.

The initiative involves “joint planning work on crisis scenarios that could potentially threaten European security”, according to a source close to the minister, including natural disasters, intervention in a crisis or evacuation of nationals.

It would be separate from other EU defence cooperation, meaning there would be no obstacle to Britain taking part after it leaves the bloc.

Not to be too cynical, President Macron is doing this as well because Britain is really a key European defense nation, is undergoing fundamentl defense modernization and will almost certainly be a key player in working Northern European defense with the Nordics who are clearly focused on defense modernization and deterrence.

Staying within a classic EU engagement on defense will only go so far to meet French interests.

At the same time, it is not really clear that excluding UK defense industry from continental European defense industrial cooperation will really get the desired outcomes which some European policy makers have indicated with regard to developing new capabilities.

According to Andrew Chuter in a recent Defense News story, the proposed new European fighter will exclude British industry as participants.

Left out in the cold by a joint Franco-German plan to develop a new fighter, Ministry of Defence officials ― supported by industry ― have been working for months on a combat air strategy to sustain Britain’s capabilities beyond the Eurofighter Typhoon, and they are determined to figure out a way forward this summer.

With more than 50 air force chiefs from around the world expected to attend the Royal International Air Tattoo at Fairford, southern England, as part of the Royal Air Force’s centenary celebrations, it is likely the British will use the event to kick-start plans to develop an eventual replacement for the Typhoons, which form the backbone of the country’s fighter fleet.

“We are definitely hoping that between the NATO summit, the Royal International Air Tattoo and the Farnborough air show in mid-July, something gets announced to get the combat air strategy underway,” said Paul Everitt, the CEO at ADS, a U.K. defense and aerospace trade organization.

Consultant Howard Wheeldon, of Wheeldon Strategic, who is very much plugged into MoD and industry circles, said nothing was set in stone yet, but he expects some kind of announcement, possibly at the Royal International Air Tattoo , which starts July 13.

“I do get the impression they will go for something big in the way of an announcement. It could be something along the lines of ‘this is what we would like to do, and we want to do it with partners.’ In part it’s meant to be a bit of a shock to France and Germany,” Wheeldon said.

And of course with a 15% stake in the F-35, and a 30% plus stake in Eurofighter, Britain is well positioned to sort out a way ahead, albeit with partners.

But two recent developments suggest divergent outcomes to how Britain will work out its defense industrial future,

The first is how Britain and the European Union have dealt with the UK’s engagement in Galileo, which is not a robust cooperative engagement outcome to say the least.

In an article by Sophia Beach of the London-based Centre for European Reform published on June 28, 2018, the challenge posed by the impact of the very negative approach to UK engagement in Galileo was highlighted.

The EU and the UK have not been able to come to an agreement over Britain’s participation in the Galileo programme. This could either set a dangerous precedent for Brexit defence negotiations in the future – or it could serve as a wake-up call for EU and UK negotiators.

Galileo is Europe’s own global navigation satellite system, planned to be up and running by 2020. While Galileo’s basic positioning services will be open to all, the EU is also developing the ‘Public Regulated Service‘ (PRS), an encrypted capability reserved for EU member-states’ militaries and governments. The encrypted signals of the PRS will ensure that the navigation service remains functional even if an adversary jams all other Galileo transmissions.

The European Commission has proposed a highly restricted role for the UK in Galileo. Like any other third country, the UK will be given observer status in agencies responsible for the EU’s space programme, but will have no power to make decisions.

The UK will be able to negotiate access to PRS.

As a third country, however, it will not be involved in any ‘upstream’ PRS activity, which means the UK will play no part in generating or encrypting the PRS signal. Finally, UK defence firms will be allowed to bid for some of the Galileo-related contracts, but cannot be involved in the design or development of security-related and PRS elements.

The UK is rejecting the EU’s offer for two main reasons.

First, the government is not prepared to simply be a user of PRS. UK companies have been heavily involved in the development of Galileo: Surrey Satellite Technology, a British subsidiary of Airbus, makes Galileo’s navigation electronics.

And a UK subsidiary of the Canadian firm CGI is developing the encryption technology for PRS. The government has argued that, if the UK is shut out of the development of PRS technology, and has no say over the future development of the service or its governance, Galileo will no longer fulfil the UK’s security needs.

Second, the British government says that if UK-based companies were no longer able to bid for Galileo contracts, this would weaken the business case for UK participation in Galileo altogether.

Because Britain considers the EU’s offer insufficient both in terms of PRS access and industry contracts, the UK is looking into building its own satellite network, potentially in co-operation with Japan or Australia, the latter one of Britain’s partner countries in the ‘Five Eyes’ international intelligence alliance.

It is not in the interest of Britain or the EU for the UK to pull out of Galileo. The loss of British expertise in space science and technology would be a loss to the entire EU project. Paul Verhoef, the European Space Agency’s (ESA) director of satellite navigation, has cautioned that shutting the UK out could lead to delays in getting to full operational capacity for Galileo.

An independent British system would also make industrial co-operation with Britain’s European partners harder, because all technology relying on navigation satellite signals would have to be equipped with receivers compatible with Galileo, its American counterpart Global Positioning System (GPS) and the UK system. This could cause trouble for projects like the Franco-British missile development programme.

A separate British system would also be expensive.

Galileo is projected to cost €10 billion by the time it becomes operational in 2020. Estimates suggest a British system would cost at least £3 billion to £5 billion – less than Galileo, because the UK already has the expertise to develop a new programme, and because the new system would only have to fulfil the requirements of Britain and potentially its Five Eyes partners, and not those of 28 EU member-states.

But for context, the UK space budget is £370 million; the defence budget is £35 billion. The UK government has publicly contemplated asking the EU to give back its past Galileo contributions. But there is little chance that the EU would agree, and the UK is understandably wary of re-opening the Brexit divorce bill negotiations.

Finally, the UK leaving Galileo also has implications for military co-operation between the UK and EU. If both sides use different encryption services, they will have trouble jointly developing operating procedures.

It would make sense to keep the UK close on Galileo – this type of positive-sum game was what many had in mind when they predicted that negotiating UK involvement in European defence co-operation after Brexit would be relatively smooth. The EU, however, was unwilling to offer the UK better access than other third countries receive.

The second is the growing outreach of British industry to other global partners.

And the crosscutting focus of both Australia and Britain in new shipbuilding approaches is a key case in point.

We have highlighted ways in which we see a natural convergence of approach and interest between Britain and Australia in building a new generation of combat surface ships.

And Australia has indeed selected a UK design for its next surface combatant.

As Rob Taylor highlighted in a recent Wall Street Journal article about the Aussie decision:

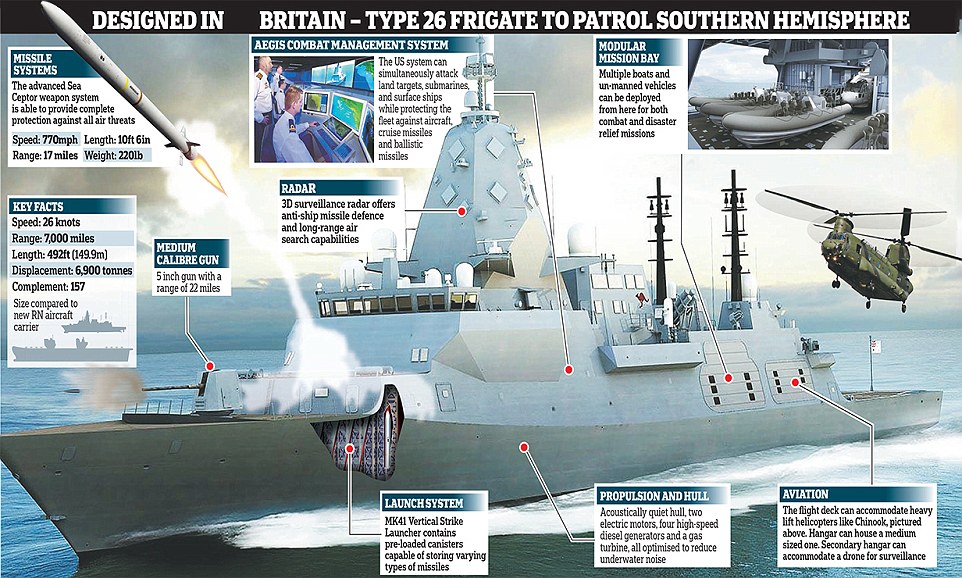

BAE Systems has won a $26 billion contest to build nine anti-submarine frigates for Australia’s navy, as the U.S. ally seeks to bolster its navy against an Asian arms race and more assertive China.

Australian Prime Minister Malcolm Turnbull will announce Friday that a variation of the British arms maker’s Type 26 frigate has been chosen over competitors from Italy’s Fincantieri and Spain’s Navantia SA. The frigates will be built in Australia by local state-owned ASC Shipbuilding, which will become a BAE subsidiary for the duration. They will begin entering service in the late 2020s.

“BAE’s Global Combat Ship will provide our nation with one of the most advanced anti-submarine warships in the world, a maritime combat capability that will underpin our security for decades to come,” Mr. Turnbull said in a statement to The Wall Street Journal.

Winning the 35 billion Australian dollar contract could boost BAE’s chances of being tapped later this year to supply Canada with 15 frigates, defense experts say. The Australian win is the second this month for the British arms maker: Last week the Pentagon selected BAE to build amphibious assault vehicles for the Marine Corps, a deal that could be worth $1.2 billion.

Putting the post-Brexit political spin and perhaps lessons learned for dealing with Europe as well on the announcement was the British Prime Minister.

British Prime Minister Theresa May hailed the announcement and said it was the ‘perfect illustration’ of the deals Brexit Britain will be striking.

She said: ‘The sheer scale and nature of this contract puts the UK at the very forefront of maritime design and engineering and demonstrates what can be achieved by UK industry and Government working hand-in-hand.

‘We have always been clear that as we leave the EU we have an opportunity to build on our close relationships with allies like Australia. This deal is a perfect illustration that the Government is doing exactly that.

‘And while this is an enormous boost for the UK economy, it will also cement our strategic partnership with one of our oldest and closest friends for decades to come.’

It would make a great deal of sense for Britain and Continental Europe to sort out ways to shape a collaborative future.

But if they can not, the UK will reach out into a broader global market and work to find other partners to shape its defense future.

The featured graphic is a computer generated mock up of BAE’s Type 26 frigate ordered by the Australian navy © BAE Systems Australia