The Canadians Rework Fleet Support

The Government of Canada has been quietly implementing a new approach to the development and procurement of in-service support programs and contracts for military equipment and fleets.

Under the banner of the Sustainment Initiative, announced in June 2016, the government adopted a multi-year target to radically transform the business of defence sustainment by developing and adopting “tailored” in-service support solutions that optimize value for Canada.

SI critical thinking considers the complete package:

1) optimize fleet availability;

2) maximize efficiency and effectiveness of in-service support;

3)get the best value for money;

and 4) ensure economic benefit for Canada.

Sustainment – a term now favoured by Canada and its allies over the more limiting “in-service support” – includes all activities related to managing, maintaining and supporting military equipment and fleets throughout the equipment’s service life. This includes such things as maintenance, repair and overhaul, engineering support, test and evaluation, and supply and logistics management.

The first public evidence of the Sustainment Initiative at work was the announcement in January 2017 of two contracts for the maintenance of the T56 engines of Canada’s CP-140 Aurora and CC-130H Hercules aircraft, and the F404 engines of the CF-18 Hornets:

“These contracts are among the first that reflect a more flexible, cost-effective approach to equipment maintenance and support,” the government said in a press release at the time. “Under a recently-established Sustainment Initiative, the government is ensuring that support contracts are flexible enough to respond to changing operational needs, while at the same time delivering best value for money.”

Since then, all new or renewed in-service support programs valued at $20 million or greater have come under close scrutiny based on the principles and process introduced by the Sustainment Initiative. This includes the $5.2 billion in-service support programs for the new Arctic and Offshore Patrol Ships and the Joint Support Ships, announced in August 2017, as well as the $230 million contract extension for support of the CC-150 Polaris aircraft, announced last December.

National Defence (DND) spends about $2.5 billion annually to sustain equipment and fleets for the Army, Navy, Air Force, and Special Operations Forces. Combining on decades of lessons learned with evolving strategic priorities of the Government of Canada, DND and its partner departments in military procurement – Public Services and Procurement Canada (PSPC) and Innovation, Science and Economic Development Canada (ISED) – have been transforming an approach to contracting in-service support programs that will meet those strategic priorities while promoting more effectiveness and efficiency.

From a business perspective, the objective of the Sustainment Initiative is quite simple: Abandon prescribed, policy-driven approaches to equipment and fleet support in favour of tailored solutions developed through principles-based, rigorously-analyzed and thoroughly documented business cases. It urges sustainment teams to consider how each support solution can deliver not only equipment that is available, reliable and safe, but also deliver value for money, flexibility to respond to changing needs, and a value proposition that delivers the most economic benefit for Canada.

The Sustainment Initiative is consistent with, and supported by the government’s defence policy, “Strong, Secure, Engaged”, which commits DND and the Government of Canada to “work tirelessly” to modernize the business of defence. It notes that modern defence business “maximizes operational output and ensures that every defence dollar is put to the best use in achieving our objectives.”

DND had begun planning the Sustainment Initiative back in 2013 when rising support costs resulting from more complex weapons systems and aging equipment were putting pressure on DND’s annual in-service support budget. Also, the procurement landscape in Canada and elsewhere had been changing and government contract policies had not been keeping pace. Performance-based contracting, for instance, which measures a contract’s effectiveness by looking at value for money and price – versus looking at cost and profit, as Canada had been doing – was becoming more commonplace.

Canada had been experimenting with performance-based contracts over the last decade, as it evolved from transactional approaches to the Optimized Weapon System Management (OWSM) and In-Service Support Contracting (ISSCF) frameworks. But DND had not yet fully developed the performance metrics to allow it to effectively manage these contracts and, through its outdated policy, had been inadvertently incentivizing the defence industry to game the cost and profit regime to, in some cases, drive up costs in the interest of profit.

The Sustainment Initiative brought about a radical change in attitude – an opportunity for DND, PSPC, and ISED to better collaborate on defence procurement files. It also presented opportunities for creativity and critical thinking, to perform more rigorous challenge and review functions, and to better document results of such efforts. And it’s a change toward more meaningful relationships with the Canadian defence industry – an important enabler of Canadian military capability.

Toward that end, the Sustainment Initiative has defined a set of principles and objectives on how to deliver military equipment support services most effectively and efficiently. At its core is a Sustainment Business Case Analysis (SBCA), which gives practitioners a tool to examine a wide range of options in the development of a tailored support solution that optimizes the four sustainment principles.

Principles of Sustainment

Performance: Defence equipment must be operationally ready and mission capable.

Value for money: Required outcomes (fit for purpose and quantity) are procured at a price commensurate with the market rate for comparable procurements.

Flexibility: An adaptable and scalable support system that can readily be adjusted to changes in operational requirements and/or operating budgets.

Economic benefit: Leverage industrial benefits from defence procurements to create jobs for Canadians and economic growth for companies in Canada.

The Planning Environment

While the elements of performance, value, flexibility and economic benefit have long guided the government’s hand, these principles balance on three strategic priorities. It’s obvious that the Canadian Armed Forces need ready, reliable and safe equipment; that government priorities must include the judicious use of taxpayer money to maintain the fleets and accomplish their intended mission; and that money invested in supporting such equipment and fleets should, in turn, result in growth for Canadian companies and jobs for Canadians.

The problem was that government most often depended on templated support solutions that were implemented with little variation across all fleets. This resulted in programs and contracts that were not necessarily the best solutions to meet both the needs of the Canadian Armed Forces and the priorities of the Government of Canada.

The solution, government reasoned, was to abandon prescribed approaches in favour of custom-built solutions that strive specifically to meet such objectives as good performance, good value for money, and good benefit for the economy.

Over the last six years, the planning environment itself has also been evolving. While re-examining other policies, the government came to recognize the need to modernize its contracting and procurement policies and procedures, to bring them into line with today’s realities.

The Defence Procurement Strategy (DPS), introduced in 2014, was a significant change. As a whole-of-government approach to defence procurement, the focus of this strategy is on timely and effective decision-making that will guide and coordinate defence procurements, and fulfill the government commitment to ensuring that purchases of defence equipment will create economic opportunities in Canada.

Among other things, its implementation introduced tri-department governance of the procurement process involving: DND, PSPC, and ISED; independent third-party review of procurements; early, meaningful industry engagement along with the introduction of the defence acquisition guide to enable awareness of future requirements; and the leveraging of defence procurements to create jobs and economic development in Canada.

Although critics regularly point to the lack of a single point of accountability as a major drawback, the DPS envisioned that National Defence would develop technical requirements and statements of work, Procurement Canada would develop contracts to address those requirements, and ISED would apply economic leveraging as a final step.

Economic Development

By aligning the Sustainment Initiative with the Defence Procurement Strategy, all sustainment solutions valued at $20 million or more are now subject to ISED’s Industrial and Technological Benefits (ITB) Policy right from the beginning. That wasn’t the case before. Now, economic requirements are considered “essential” right from initial conception of a project, rather than after the technical requirements are developed and scope of work is defined.

Any company winning or renewing a high-value competitive or sole-source defence equipment sustainment contract from the Government of Canada must undertake business activity in Canada equal to the value of the contract. As part of its proposal to win a contract, a company must include a Value Proposition, which is, essentially, an economic proposal to Canadians.

The objectives of the Value Prop are, among other things, intended to support the long-term sustainability and growth of Canada’s aerospace and defence sector, and the growth of both prime contractors and the supply chain in this country, including small and medium sized businesses in all regions of Canada.

Further, last year, ISED announced its 16 Key Industrial Capabilities – one of which is In-Service Support. This means that the decision to award an acquisition contract may be directly linked to Canadian content of the sustainment solution that is being concurrently developed. As such, new or upgraded equipment mentioned in the Defence Policy will clearly be subject to the SBCA process, and a strong Value Proposition associated with in-service support (sustainment) will be an important deciding factor in determining the winning bid.

Sustainment Business Case Analysis

The SBCA process requires that technical authorities and procurement practitioners conduct an objective, evidence-based assessment of sustainment requirements; solicitation approach; scope of work; performance management framework; and contract duration, among other factors. SBCA teams also consider best practices being used in commercial industries, and lessons learned.

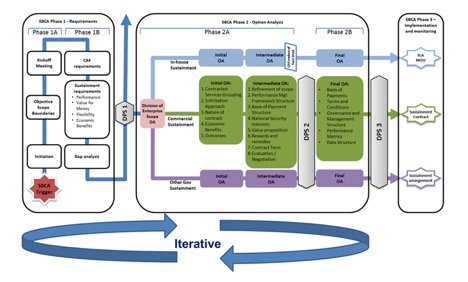

The process is divided into three phases: Requirements; Options Analysis and Definition; and Implementation and Monitoring of the contracted solution.

During the Requirements phase, SBCA teams identify the sustainment requirements and explore possible gaps between any existing solution and both fleet-specific and enterprise-wide sustainment requirements. It also assesses how well the current solution optimizes the four sustainment principles. For existing contracts being assessed for an extension period, good alignment with the sustainment principles would be a major factor in deciding to grant the extension. Otherwise, alternatives can be explored, including recompeting the contract.

For example, on a new sustainment requirement, comparisons can be drawn from solutions for similar equipment or fleets. This can be valuable in identifying gaps in current contracts or in-house services that could be addressed or avoided in new solutions.

The next step in the SBCA process – a detailed options analysis – applies to any proposed new sustainment solution, or for any existing solution that is determined to be suboptimal. While the Requirements Phase focuses on the where, when and what of the business case analysis, the new Options Analysis Phase focuses on the who and how, which leads to the sustainment and procurement strategies.

Under this new SBCA, “service groupings” (DND/CAF, industry, or foreign government arrangements such as Foreign Military Sales programs) for the division of work are now an important consideration. Other elements include: type of contract (performance-based or transactional); solicitation approach (sole-source or competitive); performance management or cost-containment structure; national security interests (stock levels or invocation of national security exception); percentage of direct ITBs that should be mandated for work in Canada; and basis of payment structure (power by the hour, or firm fixed price or rates).

The last phase of the SBCA is the finalization of the sustainment solution and development of strategies to monitor its performance and alignment with the four sustainment principles.

The Incentivized Approach

The Sustainment Initiative encourages early and meaningful industry engagement. Understanding what is happening during the SBCA process can help industry provide relevant input at the appropriate stage of solution development.

For example, the Requirements Phase is the time to discuss and understand Canada’s strategic objectives; the early Options Analysis Phase is the time to discuss scope of work and propose innovative strategies to managing equipment and fleets; the latter part of the Options Analysis phase is the time to propose contractual performance management clauses, terms and conditions, and proposals for continuous improvement during the long-term monitoring process.

A second important point for the defence industry is the need for incumbent defence contractor to continuously monitor contract performance against the four sustainment principles and foundational government requirements. Opportunities to enhance equipment performance or service, to increase value for money or flexibility, or to improve investment in Canadian industries, for instance, can mitigate the risk of significant gaps between requirements and solution when SBCA time rolls around.

The last point, suggested above, is that the awarding of contract option periods depends on all four principles, as tested during the SBCA gap analysis. It’s important to understand that the SBCA process applies not only for new or recompeted contracts, but also to existing contracts approaching option periods. If the sustainment solution is found wanting, the incumbent contractor could be at risk of not being granted the option despite meeting contract requirements.

Pricing and Profit

In 2013, the Canadian Association of Defence and Security Industries (CADSI) conducted a review of the government’s contract costing, audit and profit policies and found them to be outdated, prompting a government-commissioned review by PricewaterhouseCoopers.

The main finding of that report was that, in an effort to create trust and transparency between contracting entities, Canada must move away from a focus on auditing cost and fixing profit margins, to new policies that accommodate approaches such as performance-based contracting, which focuses on achieved results rather than transactional deliverables, and relational contracting, which focuses on creating trust and transparency between contracting entities. To achieve success with these approaches that bring mutual benefit, the conversation must be about price and value for money rather than cost and profit.

In fact, the defence industry has often pointed out over the last decade that Canada’s approach to in-service-support contracting arbitrarily restricts profit, increases cost to taxpayers, and reduces global competitiveness of the Canadian defence industry. In other words, a transactional approach (where the government buys a service at an accepted cost plus an allowable profit) invites over-servicing as a means to increase profit. Compare that with, for instance, a firm fixed-price contract that incentivizes a supplier toward efficiency, thereby driving down costs and increasing profit.

Consider the recent example of an incentivized approach to pricing for the sustainment of the CH-149 Cormorants that also demonstrates how industry can proactively introduce measures that reduce cost to government and increase profits for industry.

In this case, the contract expiry and option periods remained in the future and an SBCA was in the very early stages. However, the contractors proposed a new approach to materiel support and component repair and overhaul service. They did this in anticipation of – not as a result of – the SBCA process. Here is what they proposed:

Target pricing for materiel service, reduced from an annual average, plus a gain-share provision if savings above target are achieved.

Savings above target are to be shared equally between govt and industry.

The result? Industry innovation and efficiency created an overachievement in savings, a greater profit for industry, and a reduced cost of ownership for DND.

PSPC, for its part, has been seriously reviewing its position on cost and profit. In late 2017, the department issued a policy notification that opens the door for more innovative approaches to pricing and profit. It advises contracting officers to consider any factors or alternative approaches that could bring better value to Canada and potentially create better incentives to industry to become efficient, innovative and potentially more profitable when delivering services to government.

Next Phase

The next phase in the evolution of the Sustainment Initiative is development of a Performance Management Framework (PMF) that will integrate the program objectives and outcomes in the development of key performance indicators. In fact, the development of a PMF was one of 24 recommendations of an internal Sustainment Initiative health check carried out in 2017. It noted that no measures of success had yet been defined for SBCAs.

Key performance indicators will help SBCA teams develop quality solutions and also allow for continuous monitoring over the life of the sustainment program.

So, qualitative and quantitative measures of success remain in the future, when key performance indicators can be put in place and the long-term impact on performance, cost, and economic benefit of the Sustainment Initiative can be objectively measured. However, there is good reason to be optimistic that, with this decidedly more rigorous approach and a focus on sustainment principles, sustainment and procurement outcomes will be much improved to the benefit of the Canadian Armed Forces, our defence industries and the Canadian economy.

Brian Berube is an Ottawa-based communications consultant. Most recently, he was a senior communications strategist with the Sustainment Initiative.

This article was first published by our partner Front Line Defence.

© 2019 FrontLine Defence (Vol 16, No 2)