Assessing the Australian Navy’s New Surface Fleet Plan

The Government has released the broad brushstrokes of a plan for the structure of the Royal Australian Navy’s surface fleet and for the approach to naval shipbuilding to deliver that fleet.

This plan is based on the independent review of the navy’s surface fleet that was conducted as a key outcome of last year’s Defence Strategic Review (DSR).

We’ll refer to it as ‘the plan’ here, but the document is extremely high level with very little supporting detail. ‘Concept’ might be a better term, but let’s not quibble over vocabulary.

The plan, called Enhanced Lethality Surface Combatant Fleet, is—like last year’s public DSR—an expurgated, reduced version of the original review, combined with the Government’s responses to the review’s recommendations. An actual naval shipbuilding plan has not yet been published, although the Government has promised one for later this year and biennially after that.

That means we don’t have all the details, but with a bit of reverse engineering we can broadly compare the old and new plans.

The big picture is that the number of warships in the Navy’s surface fleet will nearly double, but there are a lot of other numbers that we can use to flesh out our understanding of the plan.

What’s in there

Based on the published plan and ministerial press conferences, this is what we know, along with some assumptions to fill in the gaps.

The Hunter class frigate program at Osborne in South Australia has been reduced from nine to six vessels. We assume the three vessels that have been removed are the last three, which were planned to have been delivered some time in the early to mid-2040s. The first one still seems to be entering service around 2033, which means the sixth likely arrive in the early 2040s.

The Government will acquire 11 off-the-shelf general-purpose frigates (GPF), with the first three to be built overseas and the remaining eight built at Henderson in Western Australia. Deputy Prime Minister / Defence Minister Richard Marles has said the first will be delivered this (calendar) decade and by the time the first Hunter was due to arrive we’ll have four GPFs. That suggests the first one would arrive around 2029 or 2030 with subsequent vessels being delivered on a one-year drumbeat.

Marles has said they will have twice the number of vertical launch system cells (VLS) of an Anzac frigate, i.e., 16. This puts them towards the smaller end of the spectrum of surface combatants. The plan provides a short list of four candidates for the GPF and some variants of these have 32 cells, but we are assuming 16 VLS in our analysis.

The plan also includes six Large Optionally Crewed Surface Vessels (LOCSV) with a capacity of 32 VLS. The concept seems to be that they will function as ‘Loyal Wingmen’ to crewed ships, supplementing their magazines and will be incapable of independent operations. They are to be built at Henderson but there is little detail on their cost or schedule.

The Government is including the six LOCSCs in its total of 26 surface combatants; this is rather generous considering they seem to have limited functions and are not comparable to crewed surface ships. Without the LOCSV the plan reaches 20 surface combatants compared to the current 11.

The Government has said it will retire the oldest two Anzac-class frigates. Moreover it will not do the previously planned Transition Capability Assurance Program (TransCAP), essentially a life-of-type-extension to the rest of the Anzac fleet. We assume that means that the fleet will retire roughly at its planned withdrawal dates, which would see all Anzacs gone by 2033.

The Arafura-class Offshore Patrol Vessel program will be capped at six rather than the original 12. The plan says they can only perform ‘civil maritime security operations’—and inefficiently at that. Since they provide no real combat power in their current form, this attenuation of the build program has no effect on the lethality of the future fleet one way or another. The plan recommends ‘further investigation… to determine how the OPVs could contribute to other mission sets’, but since Defence has made no progress on this issue in the past six years, we shouldn’t be too optimistic that it will find other uses for them.

What’s not there

The plan is essentially a short outline of how to get more frigates faster than the current plan. Consequently there are some very big gaps.

There is no discussion of the enablers required to operate a larger surface fleet. This includes things such as additional replenishment at sea ships (i.e., tankers). The Navy currently only has two. The 2020 Defence Strategic Update (paragraph 3.15) referred to the future acquisition of two multi-role sealift and replenishment ships; there is no mention of them in this plan. In short, there are no numbers around other kinds of ships (or their cost or personnel requirements) needed to make 20 surface combatants work.

There is a gaping hole around the kinds of systems we see revolutionising conflict around the world: the small, the smart and the many that can be rapidly designed, produced, expended and replaced. To use an analogy taken from the current Red Sea conflict, the plan sees us continuing to be the warships using multi-million dollar missiles to down cheap Houthi missiles and drones, rather than taking a leaf out of the Houthis’ playbook on how to impose cost and dilemmas on a powerful conventional adversary.

This is frankly extremely disappointing considering the plan states that the ‘surface combatant fleet contributes to the strategy of denial in Australia’s northern approaches’, a strategy that can be operationalised with many systems beyond surface combatants.

Overall there is no discussion of how to deliver effects differently, whether with different kinds of crewed ships, uncrewed vessels or indeed systems other than ships, such as aircraft. Beyond the optionally crewed large vessels, autonomy doesn’t seem to be a core part of Defence’s surface fleet plan or thinking. In that regard, the plan seems to start already well behind the curve.

Unpacking the dollars

Are there any significant savings to reinvest? Or, the tyranny of megaprojects

Aside from the funds realised by parking two Anzacs (indicatively less than $100 million per year), there are virtually no savings to be reinvested.

Cancelling the final three Hunters does nothing to free up cash in the (financial) decade out to 2032-33 since they weren’t going to start construction until the mid-2030s at the earliest. So there’s no short to medium-term savings there. Shrinking the program only drives up the cost of the Hunters we are getting.

Incidentally there has been media reporting (likely based on selective leaking from the Government) that the cost of the Hunter program has increased from $45 billion to $65 billion—on top of earlier increases in the program from $30 billion to $35 billion. There’s no way to validate that latest figure without more information being released. But we know from Australian National Audit Office reports and Defence’s internal Sammut review of the Hunter program that:

Defence arbitrarily ‘discounted’ BAE’s tender response by 10% in its own estimate of the cost of the frigate program at Second Pass; and

Defence provided poor advice to Government in its Second Pass Cabinet submission to Government on the cost, risk and value for money of the frigate program.

So it is entirely possible that the cost estimate has risen since it likely wasn’t very robust in the first place. If it has, we may end up still spending $45 billion on the reduced scope of six vessels. The bottom line is, continuing with a reduced fleet of Hunters doesn’t free up any money for the new plan.

The plan also states (and repeated by the DPM in a press conference) that ‘the independent analysis of Navy’s surface combatant fleet found in excess of $25 billion in unfunded cost pressures in the surface fleet acquisition and sustainment plans.’ There’s no way to know what that means. It appears similar to the unexplained claims in the DSR of $42 billion in unfunded commitments—an unexplained, unsupported claim that also cannot be validated.

What we can say is that continuing with the Hunter megaproject consumes huge amounts of funding while delivering no capability for a further decade. By the end of this financial year $4,318 million will have been spent on the Hunter program and, all going well, that only gets us to the start of construction. If we extend out and ramp up the annual cash flow ($1,250 million this year), by the time the first Hunter enters service, it’s likely that Defence will have spent over $20 billion.

When we add to this the $58 billion the Government has said it will spend this decade on the nuclear submarine program (again, just getting us to the arrival of the first ex-US Navy boat), around $80 billion of Defence’s acquisition budget is tied up in two megaprojects that will provide no actual capability this decade. That illustrates the dead hand of exquisite megaprojects on Defence’s ability to react rapidly to a changing world.

Cancelling the final six OPVs may help free up some funding this decade, but since nearly half of the total budget of $4.7 billion will have been spent by the end of this financial year with no vessels delivered and the all six still needing funding to be completed, there’s not going to be much cash freed up there. Moreover, $984 million of the total OPV budget was for larger facilities which will still be needed by the GPFs, so that will have to be spent anyway.

The DPM referred again to the $30.5 billion ‘contingency reserve’ that the Government announced as part of the last budget that is meant to kick in the latter part of this (financial) decade. However, those funds will not help fund this new surface fleet plan. That’s because the gap between the funding freed up by the old Attack-class submarine program and the ‘optimal pathway’ to an Australian SSN capability is $34 billion this decade—so that entire contingency fund, should it be delivered, will be consumed by the SSN program.

Is there ‘new’ money?

So with no new existing funding freed up, the new plan will need ‘new’ money to avoid further cuts to other ADF capabilities. Fortunately the Government has said it will fund the new plan with $1.7 billion in funding in the forward estimates (the current financial year plus the three subsequent ones) and $11.1 billion over the decade (in addition to the contingency fund discussed above). That appears to be new money for the Defence portfolio, not a re-shuffle of existing funding.

While new funding is welcome, $1.7 billion doesn’t look like that much considering Defence will need to simultaneously progress two programs to deliver the GPF: the initial overseas one, which will need to deliver in record time requiring funding almost immediately; and the domestic one. Since the first domestic frigate will need to be delivered around 2032 or 2033, money will need to be spent inside the forward estimates to get that program rolling.

We should note that additional funding will also be required beyond the financial decade. By the end of the decade, only about half of the GPFs will have been delivered, so that $11.1 billion doesn’t cover the entirety of the addition cost associated with the new plan.

The DPM stated that the $11.1 billion brings the previous $43 billion allocated to the surface fleet over the decade to $54 billion. In the absence of a detailed public Integrated Investment Program or naval shipbuilding plan, there is no way to validate that figure.

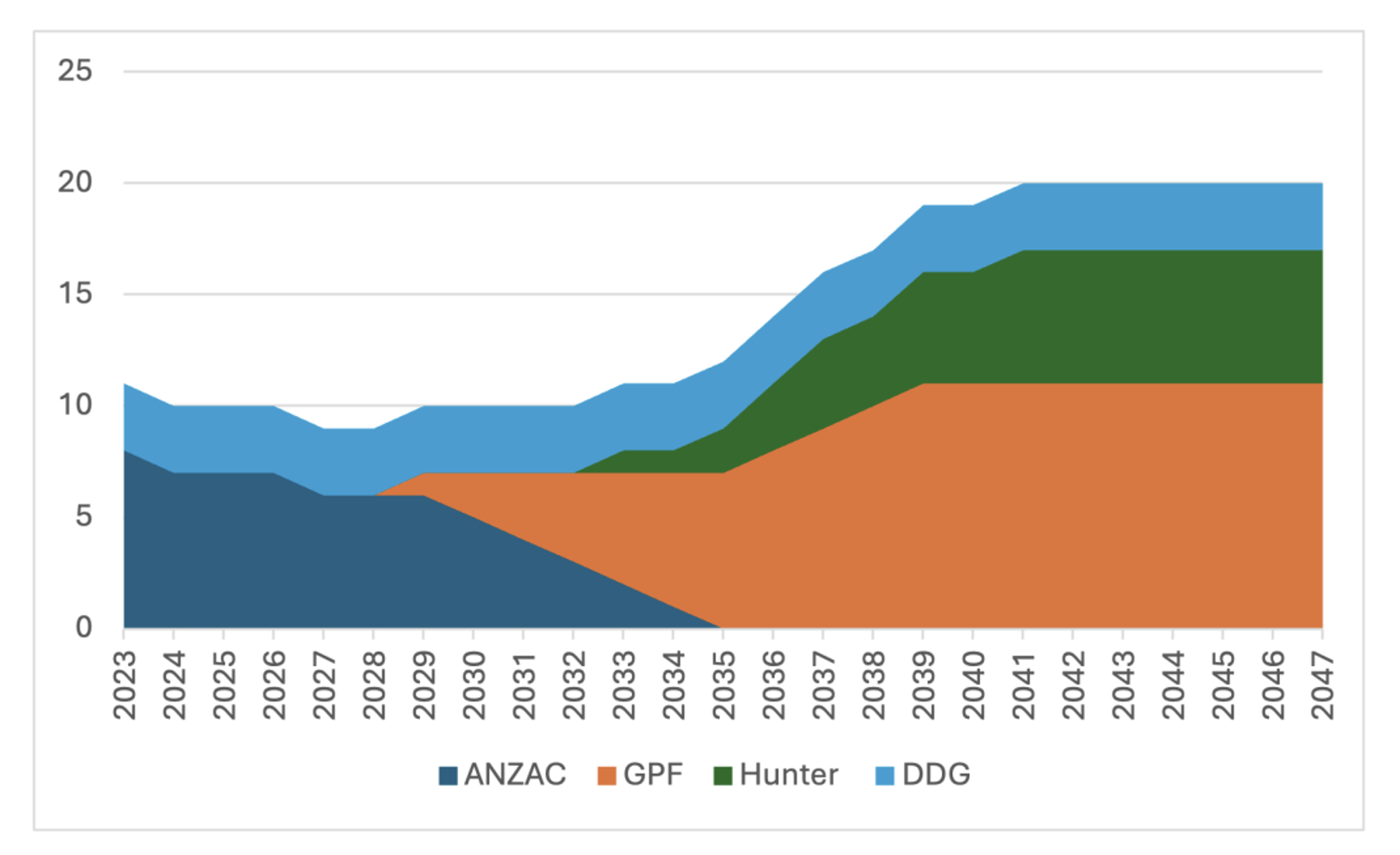

Total fleet numbers

Based on the information the Government has released and our assumptions, it’s clear that in the longer term the surface fleet will grow significantly. Even if we don’t count the LOCSV as a surface combatant, the fleet will rise from the current 11 vessels to 20 (3 Hobart destroyers, six Hunter frigates and 11 GPFs). That is a very significant increase and will grow the capability of the Navy. If the plan delivers, that final number will be achieved with the delivery of the sixth Hunter around 2041 (see Figure 1).

Figure 1: RAN surface fleet numbers under new plan

It gets worse before it gets better

Compared to the previous plan which saw the fleet stuck at 11 vessels and perhaps reaching 12 in the late 2040s, this is a vast improvement (see Figure 2). Nevertheless, in the short term, there is a decline in numbers with the retirement of two Anzacs and the fleet bottoms out at nine vessels—the smallest fleet in a very long time. Of course, with the state of the ageing Anzacs being unpredictable, it possible that could have happened under the previous plan. But the previous plan was going to perform a life-of-type-extension on the Anzacs. That’s been cancelled under the new plan. So if the rest of the Anzac fleet also turn out to have serious ageing issues, with the safety net of the TransCAP gone, the fleet could fall further below nine before the GPFs and Hunters arrive. And the deeper in the hole you start, the hard it is to recover.

Figure 2: RAN surface fleet numbers—comparison of old and new plans

Assuming all goes well, in the new plan, numbers recover to the current 11 around 2033. So while the new plan delivers an overall increase in the longer term, in the shorter term it’s no better than the old one and perhaps even worse.

That’s a function two factors.

The first is the hole the Navy needs to dig itself out that the previous Government’s failed shipbuilding plan has gotten it into.

The second is a rather large elephant in the room; the new plan does little to pursue other ways of getting maritime capable faster beyond building traditional crewed warships.

There’s nothing in the short term. Those could have included the small, the smart and the many, that is, the kinds of autonomous capabilities that Ukraine is using to great effect in the Black Sea. But beyond the LOCSV, which seems to be crewed anyway, there’s nothing in there about getting the autonomous systems that are already revolutionising warfare.

If you ask retired admirals to give you a force structure, don’t be surprised if it looks like the one they were familiar with.

Beyond 2033, numbers increase very rapidly from 11 to 20 in less than a decade as both the GPF and Hunter programs deliver while no ships are retired. Whether the Navy can manage that rapid increase is an important question.

Personnel numbers

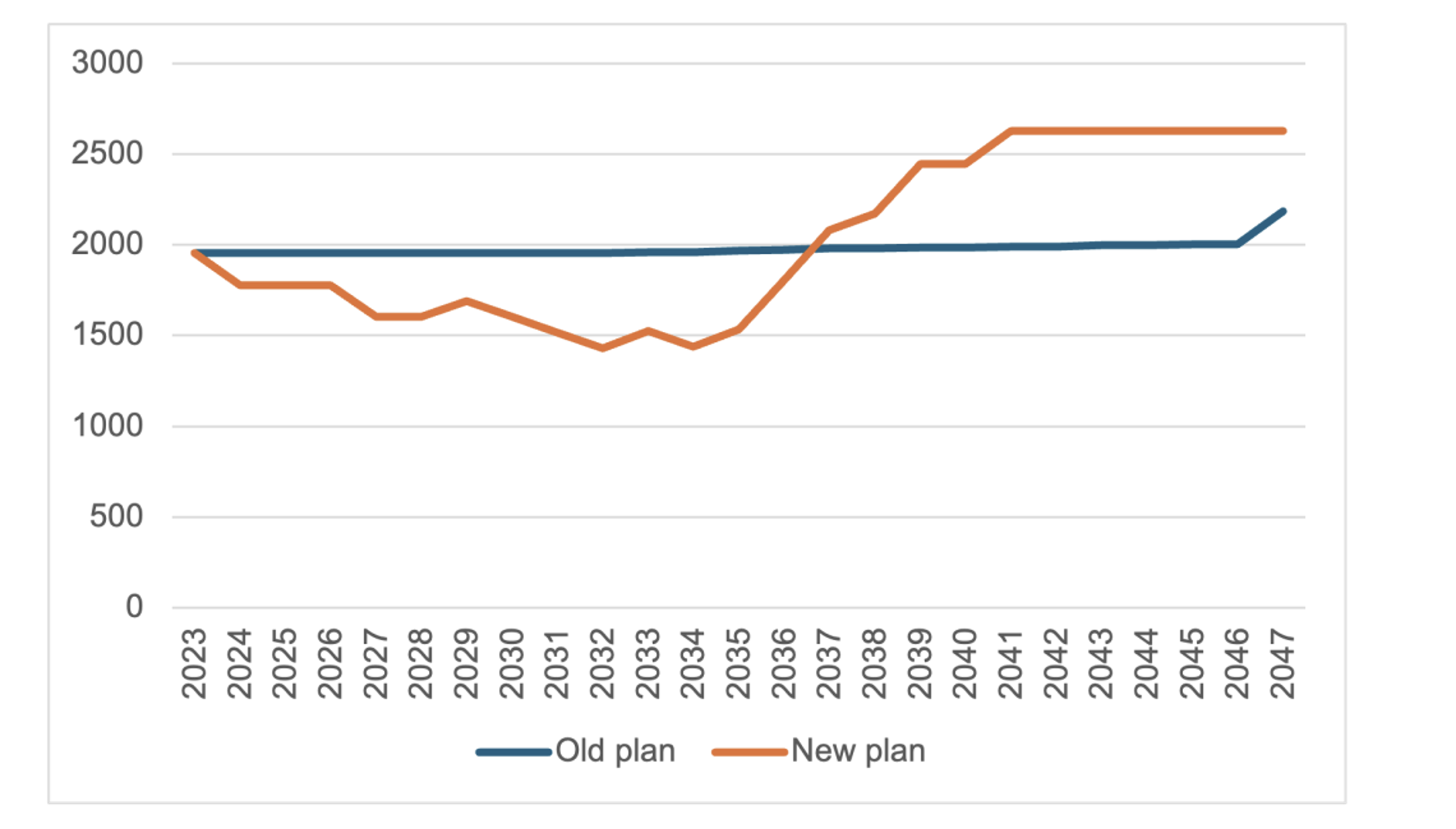

Since the number of ships is increasing, the number of uniformed personnel required will increase. There isn’t a direct correlation between ship numbers and personnel numbers, since the GPF will likely have a smaller crew size than the Anzac. Based on a review of the four shortlisted GPF candidates we’ve assume a crew of 90 compared to the Anzacs’ 177. But there will be more GPFs than Anzacs, plus the Hunters will have a similar crew size to the Anzacs. So personnel numbers will need to grow (see Figure 3 below).

We haven’t included any crew for the LOCSVs but they will also need people, whether they actually on the vessels (as Marles has said) or not, so the graph understates the numbers in the new plan.

Figure 3: Uniformed personnel numbers—comparison of old and new plans

These figures are generated by multiplying the number of ships in each class by the number of crew on each ship. That, of course, is not the true total requirement since it doesn’t take into account the fact that the total number of people needed to sustain a viable, robust workforce structure is a lot more than the number of personnel actually serving on a ship (indicatively 3 to 1). But this approach is useful in generating a comparison in relative terms.

More people are needed but there’s no plan to get them

What becomes clear is that in contrast to the old plan that had stable personnel numbers throughout the transition, there is significant churn in the new one. The previous plan had a steady personnel requirement of around 2,000 during the transition. The new one drops from around 2,000 to below 1,400 around 2032 before needing to climb up to around 2,600 by 2041. Growing from 1,400 to 2,600 in around 10 years will be challenging (particular when we consider the 3 for 1 metric), so the Navy will need to hang on to as many of the original 2,000 as it possibly can, even if it doesn’t have ships to put them on in the intervening period. That will require some creative HR strategies.

We should note that at the same time as this growth has to occur, the Navy will also need to grow the number of submariners by 2.5 to 3 times the current number (indicatively from 800 to 2,000-2,500). Before this latest round of additions to the Navy in the surface fleet plan, it needed to grow from around 15,000 to 20,000. This new plan adds several thousand to that target. Considering that the Navy has grown by only 800 people in the past eight years, crewing the future fleet will be extremely challenging. The new target could take the Navy 80 years to reach based on its recent performance.

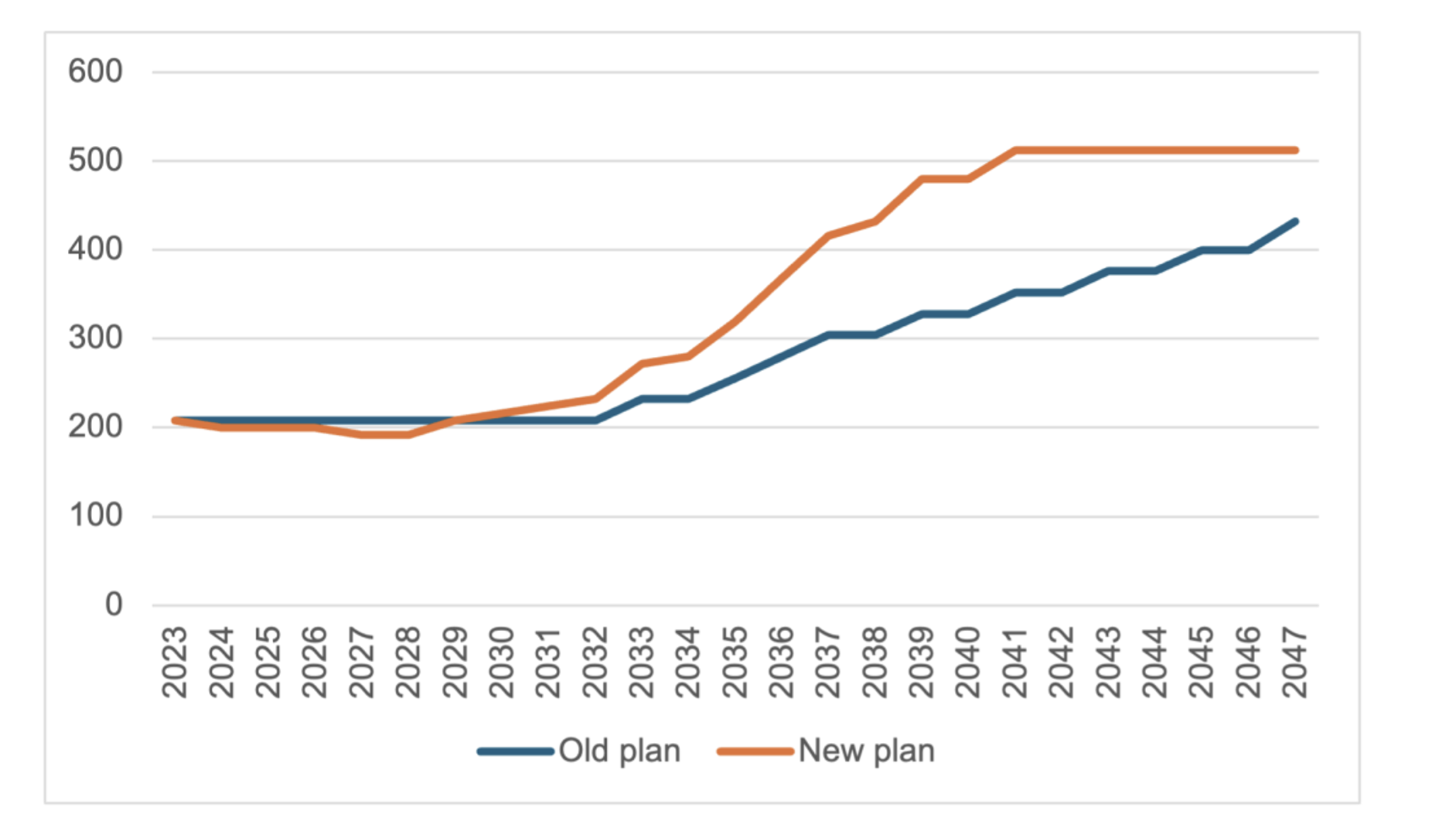

VLS numbers

It’s difficult to quantify capability in a single number since surface combatants perform so many tasks with so many systems, but VLS cells have become a convenient (if not completely accurate) proxy for maritime combat power. Figure 4 gives a comparison of the old and new plans. After an initial dip aligned with the retirement of the first two Anzacs, the new plan gets more cells to sea faster, overtaking the old plan by 2030 and reaching 512 in 2041. The old plan maxes out at 432 in 2047.

Figure 4: Total VLS cells—comparison of old and new plans

However, the difference could be significantly greater than 80. This comparison assumes that the GPFs will have 16 VLS cells; if the Government selects a design with 32 cells, the difference between the two plans will be 256. And if we add the 192 on the LOCSVs, the difference gets to 448. Without a schedule, however, it’s difficult to chart that growth. The published plan says the RAN should be a fast follower of the US Navy, but the latter doesn’t have this capability yet.

Moreover, it’s not stated in the plan whether the LOCSVs will be built concurrently with the GPF or after them. Things may become clearer when the new shipbuilding plan is published later this year.

There also significant differences between the plans in other systems, such as towed array sonars, which start to grow from 2029 under the new plan with the delivery of the first GPF.

Of course, one could argue that a weakness in the new plan is that it reinforces our reliance on exquisite, multi-million dollar missiles that will be expended in large quantities and cannot be replaced (refer to Houthi analogy above).

As noted earlier, there is nothing in the plan about exploring other ways to do business.

Overall observations—this is your grandfather’s force structure plan

In the longer term, the new surface fleet plan has the potential to significantly increase the Navy’s capabilities. There will be, however, significant challenges to achieve this growth at the same time as the SSN’s enter service. Uniformed personnel growth is the most obvious one. Enablers such as tankers will likely be required but these are not discussed in the plan. There are of course risks around industrial capacity which we haven’t considered here.

In the shorter term, the new plan doesn’t deliver any increases to capability in the crucial period of the 2020s—the period that most strategic assessments state is the one with greatest strategic risk. In the best case, the first GPF arrives around 2029 or 2030 (five years after the Anzac frigate it is replacing has left service). Even then, to achieve that, a number of factors will need to align:

- Defence will need to conduct a selection process in record time;

- the Navy will need to moderate its requirements and accept an off-the-shelf product, which likely excludes wishes such as the Aegis combat system;

- and there will need to be a seamless transition from overseas to domestic production.

If those factors don’t align, it’s hard to see the GPF’s schedule being any better than the Hunter’s

In next four to five years, there is no improvement capability improvement. In fact there is a decrease in capability as the Government ‘divests to reinvest’ by retiring two Anzac frigates.

Unfortunately, the new plan is completely silent on the kinds of systems that could deliver capability quickly, such as the small, the smart and many, which are transforming warfare. Other than a rather half-hearted reference to LOCSV, there is no discussion of greater use of autonomous systems, let alone commitments to fund them.

Similarly, the new plan doesn’t offer different approaches to old tasks, for example using more aircraft to conduct anti-submarine warfare, whether based on a small aircraft carrier operating rotary-wing aircraft and uncrewed systems or land-based maritime patrol aircraft. Considering it’s very debatable whether frigates are the most effective platform for ASW and are extremely cost-ineffective for delivering land strike, it seems like this was a lost opportunity to do things differently.

Plus other areas of vital Navy capability have simply gone missing—what has happened to mine clearance, for example? Our small fleet of mine hunters is nearing its withdrawal date but a life-of-type extension was cancelled some years ago in favour of acquiring a new fleet of ships that would operate uncrewed systems from outside the minefield. News on that plan has dried up, suggesting progress has as well.

Overall, the new plan may well produce a larger surface fleet over the next 20 years, but it will essentially be the same kind of surface fleet as it is today. Whether that will result in a relevant Navy in 20 years’ time is a separate discussion.

Dr Marcus Hellyer is Head of Research at Strategic Analysis Australia.

This article was published by Strategic Analysis Australia on February 21, 2024.

Editor’s Note: The missing link in the conceptual re-design — the driving force of autonomous systems.