Monitoring Foreign investments in Europe : Filling the Gap

The European Union’s adoption on March 21st of a new “framework for the screening of foreign direct investments into the Union,” as published in the Official Journal of the EU, is a major step forward towards a growing common awareness on the Old Continent about the risks involved in unchecked foreign investments.

It also reflects the beginning of some form of unity on a long-standing issue that could never get passed the form of EU Parliament Resolution at best, like the call made in May 2012 entitled EU and China : Unbalanced Trade ? which happened a year after the attempted takeover of Dutch cable-maker Draka by the Chinese company Xinmao.

Even though China is not explicitly targeted, the timing of this new legislation as EU leaders meet for two days within the European Council in part to prepare the upcoming EU-China Summit planned for April 9th is no accident.

“China can no longer be regarded as a developing country.”

This sentence, which comes from the latest European Commission Report on the state of relationships between the EU and China and ten-point plan of action to address the latter in a new balanced way, sums up the change of mood in Europe regarding everything Chinese.

One can identify several triggers to such a switch.

- The coming to power of President Xi Jinping and his new strategic vision embodied in China’s five-year plan (2016-2020) and Made in China Strategy (2015) and implemented with the development of a more agressive approach to take-overs of strategic assets, such as the Silk Road Fund and the Asian Infrastructure Investment Bank (AIIB) meant to support the global One Belt One Road (OBOR) initiative ;

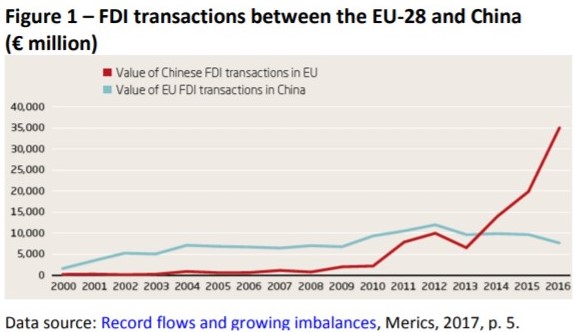

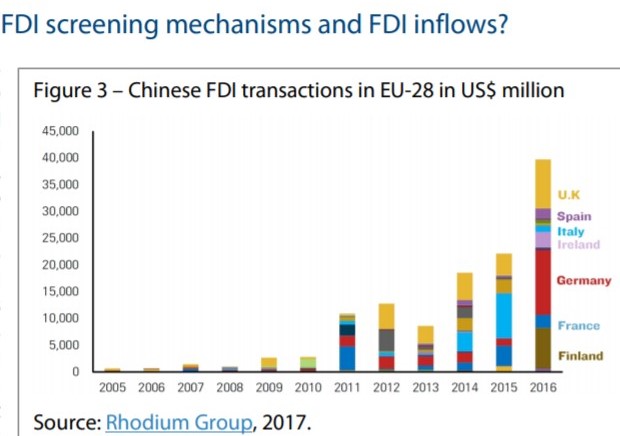

- The growing scissors effect between foreign direct investments between the EU and China (see chart below) ;

Source: page 2 in >>> http://www.europarl.europa.eu/RegData/etudes/BRIE/2017/603941/EPRS_BRI(2017)603941_EN.pdf

- The increasing number of Chinese acquisitions of – or attempts to acquire or control through majority shares – strategic assets, which abound. To name just two : the Greek port of Piraeus – which COSCO Shipping purchased 67% of its capital in 2016- is part of the 29 ports and 47 terminals now ran by Chinese companies in more than a dozen countries in Europe and elsewhere ; another recent exemple is the debate over the fate of the Toulouse airport, located at the heart of France’s aerospace industry and research community, of which Chinese consortium Symbiose’s firm Casil owns 49,99 %.

- A new willingness to promote a true European defense – prompted by Russian actions starting with Ukraine and Crimea, as well as other factors such as Brexit, President Trump’s rhetoric about NATO allies, the arrival of President Macron in power with a passion to resurrect the old Franco-German drive in European institutions, and so on.

Intersecting all these trends is the awareness that Europeans have to protect their industrial base for economic reasons of course, but also for security reasons like used to be the way at the height of the Cold War.

Infrastructure and mobility are for instance now hot topics in the EU, each member being for instance required by the end of the year to establish national plans for military mobility and focusing on improving interoperability.

The same goes about cybersecurity, as the debate about Huawei’s 5G mobile network investment in Germany (with the US warning about restricting intelligence sharing with Berlin if the deal goes on) shows (to note, there is a similar debate in France, but the battle in this case is more about “digital sovereignty” and the promotion of a European champion able to compete with the GAFAs, which are now required to pay a tax based on their revenue made in France).

Indeed if China is mostly targeted, Russia is also part of the motivation and the reason why Nordic countries went finally on board with the new screening legislation, which rapporteur is French conservative (“Les Républicains”) Franck Proust, member of the European Parliament.

So what does this new legislation really mean ?

One can compare the new mechanism to the US CFIUS established since 1975 in the sense that it provides a way to monitor foreign direct investments on a EU-wide basis. The regulation states the main objective – i.e. « provide (…) with the means to address risks to security or public order » – the following way :

(8) The framework for the screening of foreign direct investments and for cooperation should provide Member States and the Commission with the means to address risks to security or public order in a comprehensive manner, and to adapt to changing circumstances, while maintaining the necessary flexibility for Member States to screen foreign direct investments on grounds of security and public order taking into account their individual situations and national specificities. The decision on whether to set up a screening mechanism or to screen a particular foreign direct investment remains the sole responsibility of the Member State concerned.

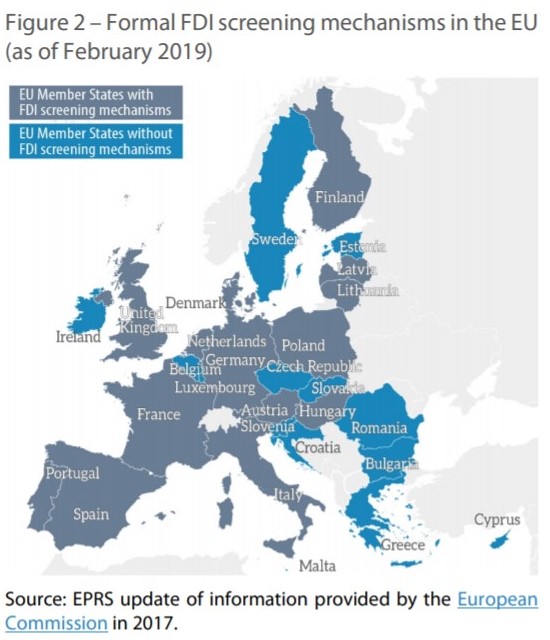

If national means to do so exist in some countries, it is not the case in all of them, while policies and preferences differ a great deal among them.

Article 8 of the regulation details the range of investments targeted as they affect “those projects and programmes which involve a substantial amount or a significant share of Union funding, or which are covered by Union law regarding critical infrastructure, critical technologies or critical inputs which are essential for security or public order.”

That includes dual-use technologies – such as artificial intelligence, robotics, nanotechnologies, etc -, but also sectors related to energy, data processing ans storage, health, transportation, communications… The supply chain and access to strategic resources (including food security) should also be affected. Cyber also, with, in addition a new focus on access to personal data, as well as on media freedom….

An annex related to Article 8 indeed lists some specific programs connected in particular with space, telecommunications, energy and transportation:

List of projects or programmes of Union interest referred to in Article 8(3)

- European GNSS programmes (Galileo & EGNOS):

Regulation (EU) No 1285/2013 of the European Parliament and of the Council of 11 December 2013 on the implementation and exploitation of the European satellite navigation systems and repealing the Council Regulation (EC) No 876/2002 and Regulation (EC) No 683/2008 of the European Parliament and of the Council (OJ L 347, 20.12.2013, p. 1). - Copernicus:

Regulation (EU) No 377/2014 of the European Parliament and of the Council of 3 April 2014 establishing the Copernicus Programme and repealing Regulation (EU) No 911/2010 (OJ L 122, 24.4.2014, p. 44). - Horizon 2020:

Regulation (EU) No 1291/2013 of the European Parliament and of the Council of 11 December 2013 establishing Horizon 2020 – the Framework Programme for Research and Innovation (2014-2020) and repealing Decision No 1982/2006/EC (OJ L 347, 20.12.2013, p. 104), including actions therein relating to Key Enabling Technologies such as artificial intelligence, robotics, semiconductors and cybersecurity. - Trans-European Networks for Transport (TEN-T):

Regulation (EU) No 1315/2013 of the European Parliament and of the Council of 11 December 2013 on Union guidelines for the development of the trans-European transport network and repealing Decision No 661/2010/EU (OJ L 348, 20.12.2013, p. 1). - Trans-European Networks for Energy (TEN-E):

Regulation (EU) No 347/2013 of the European Parliament and of the Council of 17 April 2013 on guidelines for trans-European energy infrastructure and repealing Decision No 1364/2006/EC and amending Regulations (EC) No 713/2009, (EC) No 714/2009 and (EC) No 715/2009 (OJ L 115, 25.4.2013, p. 39). - Trans-European Networks for Telecommunications:

Regulation (EU) No 283/2014 of the European Parliament and of the Council of 11 March 2014 on guidelines for trans-European networks in the area of telecommunications infrastructure and repealing Decision No 1336/97/EC (OJ L 86, 21.3.2014, p. 14). - European Defence Industrial Development Programme:

Regulation (EU) 2018/1092 of the European Parliament and of the Council of 18 July 2018 establishing the European Defence Industrial Development Programme aiming at supporting the competitiveness and innovation capacity of the Union’s defence industry (OJ L 200, 7.8.2018, p. 30). - Permanent structured cooperation (PESCO):

Council Decision (CFSP) 2018/340 of 6 March 2018 establishing the list of projects to be developed under PESCO (OJ L 65, 8.3.2018, p. 24). »

The mechanism is one of exchange of informations and is non-binding however.

It requires member states to inform the Commission about foreign direct investments when relevant, but other member states can only comment :

(17) When a Member State receives comments from other Member States or an opinion from the Commission, it should give such comments or opinion due consideration through, where appropriate, measures available under its national law, or in its broader policy-making, in line with its duty of sincere cooperation laid down in Article 4(3) TEU.

The final decision in relation to any foreign direct investment undergoing screening or any measure taken in relation to a foreign direct investment not undergoing screening remains the sole responsibility of the Member State where the foreign direct investment is planned or completed.

Having to balance legitimate security concerns with as legitimate sovereignty considerations based on free trade, the legal impact of the text and being “opinionated” appears therefore limited.

Such a move should therefore be considered more like a framework for cooperation allowing to monitor and filter in order to “retain the best,”as Franck Proust describes it, as well as a warning mechanism.

The worry expressed by some analysts and business lawyers is however three-fold.

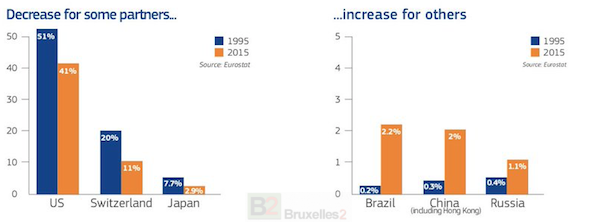

First, it may affect the reputation and competitive edge of the EU as the most welcoming trade partner at a time of slow growth when investments are crucial. Indeed, with the value of exchange of goods between the EU and China larger than1.5 billion euros a day, the EU is China’s biggest trading partner and China is the EU’s second after the United States.

The stakes are high and many European countries – especially those without a strong industrial base – desesperately need these investments – whether in infrastructure like the 16 + 1 Group – a group gathering 11 EU members and 5 Balkan countries under the initiative of China and focusing on the funding of projects such as the Belgrade-Budapest High Speed rail, or other ares such as health (recent shortages of drugs in Europe have highlighted our overall dependency on Asia in this crucial public health field as well…) -.

Second, even though not constraining, the regulation may be enough to discourage investors, as more time, uncertainty about feasibility and therefore cost could be the ripple effects, especially for firms with Chinese ties which will go under more scrutiny.

Third, it has already an impact on national legislations being reinforced or established, while the new regulation will be adding an extra layer in a bidding process complicated enough, and could be used to break deals or favor other competitors, even through mere political exposure and pressure.

It happened in the past both in the United States with the CFIUS system and in Europe just through resolution, and it is indeed the goal and the deterrent impact which the legislators hope to achieve with this new bold statement.

However, as the signing into law last summer of the Foreign Investment Risk Review Modernization Act (FIRRMA) by President Trump shows, the initial CFIUS mechanism seems to have been circumvented by Beijing via other means, such as real-estate acquisitions and technology transfer through joint-ventures, to name a few.

The new battle emerging from Brussels means President Trump is not alone anymore in his efforts to deal with the Chinese challenge.

But then again, China and Russia do not have to comply to a levelled playing field in non- US and non-EU European areas…

EU LegislationEU and China Trade

communication-eu-china-a-strategic-outlook

This article was first published by Breaking Defense on March 26, 2019.